When my daughter first started to read, she loved to sit and page through the Shel Silverstein books of poetry. I’d overhear her chirpy little voice melodically reciting the poems in her bedroom to her audience of stuffed animals. The books are aged but quality hardbound copies, gifts from my parents when I was young and bearing inscriptions such as “Merry Christmas, 1992.”

As my daughter got a bit older, questions started to bubble up from the poems, like, “Why is there a curly string on that phone?” and “What is that v coming out of the top of that big tv?”

Technology has changed dramatically since Silverstein penned these poems, opening up new topics of conversation across generations.

Technology change has also greatly complicated something else: Simply finding a photo.

I am in my 40s. I have lived through the transition from 35 mm film to digital cameras supported by memory cards to predominantly using my smartphone to take pictures. I don’t even have a camera purchased within the last decade! I should probably take a hint from Artifcts’ Tech Detox checklist to dispose of a few. But maybe not the first big 35mm I bought when I was leaving to study abroad in Sweden. It’s a bit sentimental to me.

I digress!

Fast forward to last weekend when I wanted to find a series of photos I took when my sister and I visited NYC in 2005 just after Thanksgiving. I turned to my husband and said, “What did we even take photos with in 2005? Did we have cameras on our phones then?” He shrugged and hazarded a guess that we were still in the memory card digital camera era.

I looked for over an hour through portable hard drives and photos in cloud storage to no avail. Making this search more complicated was the fact that for some reason, the dates on the photos in the folder viewer were all identical, like it took on the date that I transferred the photos to the hard drive.

What’s next for my photos?

My photo problem is growing worse by the day. I’m guessing yours is, too. Did you know that on average we take 20 photos a day? That’s 5.9 billion photos every day worldwide.

And that’s not even factoring the boxes, albums, and bins of photos that my parents will someday pass on to my siblings and me. I need to get my act together now before the deluge arrives.

My action plan looks something like this:

-

-

- Corral all my photos—physical and digital—into one place and back them all up on a portable hard drive and in the cloud, because I do not want to lose anything.

- For physical photos with no digital version, decide to (a) buy a scanner and digitize myself, (b) hire a professional photo manager to tackle this and so much more, (c) take the photos into a local shop or a mail away company to digitize, and/or (d) use the Photomyne app to scan the photos rapidly without even removing them from their album pages. Making this effort far easier could be technology like Mylio. It is designed to corral your photos into a single library and to make the next step easier too…

- Sort my photos, at scale, which to me sounds incredibly daunting and unpleasant. This is where I hope that the metadata in at least the digital-native photos will expedite the process because it can reveal time, date, and place. Plus, even the tech built into the modern smartphone can sort by type of photo (yes, it knows how many selfies you’re taking) and provides facial recognition, too.

-

-

-

- For scanned photos, well, that’s another matter. There’s no metadata unless I presorted them and have at least an event name or year associated with them or the camera-imposed dates on them (but then, was my camera date and time accurate?).

- Tag favorite pics that I want to write about, share with others, or otherwise bring back to life, maybe hang on a wall. You know, the joyful part of photos. Even last weekend while hunting for those NYC photos, I came across a beautiful photo of my friend’s mother who has since passed. I paused to text her the photo so I would not forget and so she’d have this sweet image to add to her own collection.

-

What about my NYC photos?

Hopeless.

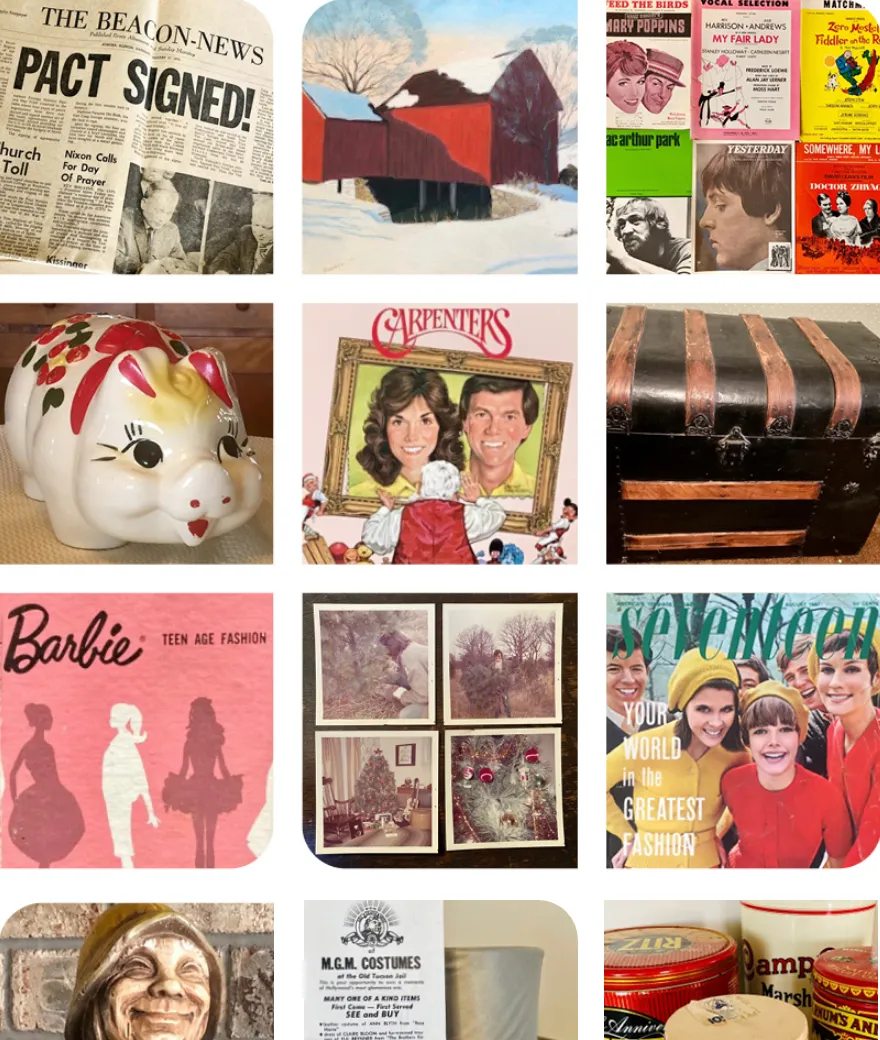

For now, I have given up looking for the original, digital versions of my NYC photos. I pulled down the heavy cardboard box from the office closet, opened up the decaying photo album I knew contained print copies of the photos I was seeking, and took photos of the photos.

The entire inspiration for looking for this set of NYC photos was a pin that my daughter noticed on my sweater on a recent cold day here in Austin, Texas. She asked if it was new, and the answer to that question led me back in time to one of my favorite stories to tell people about a Thanksgiving nearly 20 years ago that throws me into fits of laughter even in the telling of it today.

Now, I can be sure my sister will never live down this memorable Thanksgiving and my daughter will know the story of the pin, a future heirloom. My story is Artifcted to stay.

Maybe you have a similar favorite story you tell about a family member to Artifct and share. Some stories are too good to allow them and the photos that add color to the telling to fade away!

###

We love writing about photos and helping you capture the meaning behind them. Explore these ARTIcles for more!

© 2025 Artifcts, Inc. All Rights Reserved.

Live and share your legacy with Artifcts!

Live and share your legacy with Artifcts!