Reading time: 12 minutes

In honor of National Estate Planning Week, we thought we’d take a deep dive into the world of appraisals with an Ask Me Anything with our dear friend, colleague, and Ally in 'Stuff,' Sarah Reeder, Founder of Artifactual History Appraisal.

In addition to being an expert on ‘stuff,’ and specifically the value of ‘stuff,’ Sarah is also author of the book Ray Eames in 1930s New York, co-editor of Worthwhile Magazine™ and co-creator of The Art Elevator Collector’s Club. Read on to learn more about what she does as an appraiser, when to contact an appraiser, and even those questions we all want to ask (but may be afraid to!), such as the difference between an appraisal and a valuation.

Heather Nickerson, Co-founder of Artifcts: For our members who are new to the appraisal process, how would you sum up what you do?

Reeder: I like to think of what I do as being part lawyer, part accountant, and sometimes even part therapist! It might surprise some people, but appraisals are nothing like what you see on TV. My work entails numerous hours of research, the preparation of legal documents, and meeting meticulous professional requirements for appraising items to establish a value in a specific level of the market on a specific day (called the effective date) for a specific intended use. (We’ll come back to that later!)

Appraisals are nothing like what you see on TV...

The work appraisers do is a very specialized type of professional service akin to an attorney or an accountant that requires a lot of time and focused research, so the very quick and informal “off-the-cuff” depictions of appraising we all see on television have edited out the lengthy preparation (because it would be pretty boring to watch!) that goes into those short segments we see. But I wish it was more widely known that there is so much more work that goes into appraising than the 2-minute clips we see onscreen.

The therapist part sometimes comes into play because as you know so well here at Artifcts, objects can hold powerful memories and inspire strong emotions, totally independent from what their monetary value might be. Sometimes it’s a delicate conversation when the “heart value” and financial value are not aligned, and that is where I rely on market data and research to help individuals understand the current market conditions and corresponding value of the item. I always emphasize that market conditions should not diminish the positive sentimental associations they have with an item—they just happen to be the lens that appraisers must use in our professional work.

Nickerson: So, getting down to the nitty gritty, can you walk us through a typical day?

Reeder: There is no one typical day. That is one of the many things I love about being an appraiser, you never know what you’ll be working on next! There are two types of appraisals I spend most of my time on insurance appraisals and estate appraisals. And yes, they are different!

When I am working on an insurance appraisal, I am creating a legal document that will protect you and your items in the event of damage or loss. These appraisals are for the retail replacement value of the object and in doing so, pins that object and that value in time. That specific moment in time is called the effective date of the appraisal, and all appraisals have effective dates.

The effective date of appraisal is so important in all appraisal report intended uses, because it provides critical context for the numerical appraised value. The markets for art and antiques are always changing, much like the stock market we are more commonly familiar with, so the appraised values need to be contextualized to a specific day, because on the day before or the day after market conditions may have been different. For insurance appraisal reports, the effective date is typically the day I inspect the items in person as it establishes the condition I witnessed on that day.

The markets for art and antiques are always changing, much like the stock market...

When working on these types of appraisals, I spend a lot of time researching the object, documenting it with photos and a detailed description, cataloging it with a standardized format that will allow future users of the appraisal report to know the characteristics of the appraised item, researching the specific level of the market for similar items for the appraisal report’s intended use, and then developing an appraised value based on all the above.

In the case of insurance appraisals, the appraised value is generally the replacement value of the object (i.e. what would it cost to acquire the same exact or very similar object in a short period of time from a retail dealer). For example, if I am appraising a painting by a particular artist for insurance purposes, I’m going to identify which galleries represent that artist or sell paintings by that artist, and then compare their available inventory and pricing (which often is not publicly available and requires outreach to the galleries) to the appraised painting in terms of subject, size, condition, era of the artist’s career, and other factors.

Based on the current retail data I can obtain, I then make adjustments up or down if needed relative to the appraised painting, and document all relevant research for my appraisal client workfile, which I am legally required to keep for a minimum of 5 years. The final number after the specific adjustments from the comparable records accounting for differences from the appraised item is the appraised retail replacement value. So it’s all a lot more complicated and research-intensive than what the public typically sees in popular depictions of appraisers on television.

Insurance appraisals are very different from estate appraisals. Estate appraisals are not used for insurance coverage. Estate appraisals are prepared at fair market value and are required in some situations to be filed with the federal government or relevant state and local governments for estate tax filing. The legal professional handling an estate is the one who determines whether this is required in specific estate situations.

While insurance appraisals are typically prepared at retail replacement value, estate appraisals are prepared at fair market value, which is often quite a bit lower. The United States government defines fair market value as

"The price at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts." According to Technical Advisory Memorandum 9235005 [May 27, 1992], fair market value should include the buyer's premium. [Source: Treasury Regulations Section 20.2031-1 (b).]

For estate appraisal reports, the effective date is typically at the time of the death of the deceased. This is very different than with insurance appraisals as it could take an executor months and months to close out an estate and yet the value is still pegged to the date of death. There is something called the “alternate effective date” which is 6 months after the date of death, which the estate can elect to use if the market has changed significantly in that time period. I always like to confirm which effective date the estate is using as this is a critical factor in guiding my valuation research.

Nickerson: Tell us a bit about the tools of your trade. What do you take with you when you visit someone’s home to start an appraisal?

Reeder: I am pretty consistent. I always take:

-

-

- a good camera for capturing documentary photos

- a tape measure so I can obtain the dimensions of artworks and the other items I am appraising

- a clipboard and paper so I can take notes on-site that will later be expanded with research back in my office

- a blacklight for examining artwork for inpainting and other restorations

- a jeweler’s loupe for studying silver marks and other small details

- a flashlight for studying artist signatures and providing additional ambient lighting for my photographs in dark locations.

I carry multiple flashlights and measuring tapes with me. If one breaks while I am on-site, I have a backup available to be able to continue working.

These tools are necessary, because I have to make sure I capture all the precise details that make your object unique. If it is artwork, is there an artist signature? Any blemishes or marks? Water or sun damage? All of these things are important to ascertain the value of an object, and I need to be able to document them while onsite.

Sarah's trusty go-everywhere appraisal bag full of her tools of the trade.

Nickerson: Some people, and I admit I was one of them at the beginning, may not know the difference between a valuation and an appraisal. Could you help explain what makes the two different?

Reeder: Sure! The Uniform Standards of Professional Appraisal Practice (USPAP) define valuation services as:

“A service pertaining to an aspect of property value, regardless of the type of service and whether it is performed by appraisers or by others.”

An appraisal is defined by USPAP as:

"(noun) the act or process of developing an opinion of value; an opinion of value.

(adjective) of or pertaining to appraising and related functions such as appraisal practice or appraisal services.

Comment: An appraisal is numerically expressed as a specific amount, as a range of numbers, or as a relationship (e.g., not more than, not less than) to a previous value opinion or numerical benchmark (e.g., assessed value, collateral value).”

In terms of the general popular context of these two words outside of their specific USPAP definitions, a valuation is typically more closely associated with ballpark estimates and not with a legal document. Think of it as something that will get you basic guidance, such as getting an approximate sense if an inherited collection is simply sentimental and has no monetary value, or conversely, if it might have significant monetary value.

A valuation is typically more closely associated with ballpark estimates ...

Appraisals are legal documents. A verbal ballpark numerical range cannot be used in court to settle an estate, with the IRS to document tangible assets for tax purposes, or with an insurer to document items for an insurance policy. USPAP-compliant written appraisal reports are needed for those intended uses.

Nickerson: Are there any red flags our members should watch out for when hiring an appraiser?

Reeder: One of my personal red flags is if the appraiser essentially says, "I will tell you how much it is worth and then purchase it from you.” There is a major conflict of interest there, and their interest may not be in your best interest.

Another major red flag is if an appraiser is not USPAP-compliant. USPAP is a very important professional and ethical standard regulating appraisers to help protect users of appraisal services.

It’s always best to look for an independent appraiser who is USPAP-compliant, and ideally is also a member of one of the professional associations for appraisers such as the Appraisers Association of America (AAA), the International Society of Appraisers (ISA), or the American Society of Appraisers (ASA). I am a Certified Member of the Appraisers Association of America and a Certified Member of the International Society of Appraisers.

You also want to make sure that any appraiser you hire has expertise in YOUR object(s). A jewelry appraiser may be great for your jewelry collection, but not your collection of mid-century modern furniture and vice versa. In USPAP, this is called the “Competency Rule”—basically, is this appraiser competent to appraise your items? If they aren’t, they shouldn’t do it.

You also want to make sure that any appraiser you hire has expertise in YOUR object(s)...

Nickerson: When should people hire an appraiser? Are there any life transitions that may necessitate an appraiser?

Reeder: Life transitions are a great time to take stock of what you have and what’s it worth. Some common life transitions where it can be useful to engage an appraiser are:

-

-

- If you have inherited potentially valuable items such as artwork. An appraiser can provide expert guidance on their value and prepare an insurance appraisal report so they can be scheduled and protected with your insurance company.

- If you plan on moving it can be very helpful to have valuable items appraised for insurance purposes in advance or to update an existing appraisal to make sure the insurance coverage is current.

- For estate filing purposes when someone has passed. The estate’s attorney will direct whether an estate appraisal is needed.

- For proactive estate planning purposes—if you have large collections, it can be helpful to get a sense of their value and how they might be structured in your estate plan for maximum tax efficiency for your heirs (again, your attorney will be a very helpful resource in this process).

- Sometimes divorces are another life transition that may require an appraiser for the equitable distribution process.

I get called into homes frequently for what I call "on-site consultations" when people have a lot of things (usually inherited) and they are worried about missing something that is potentially high-value. These consultations do not necessarily have accompanying appraisal reports. Most appraisers will charge the firm's hourly rate for this type of service. It can be really helpful for people in "getting unstuck" so they can move forward and make decisions for what's next for it all!

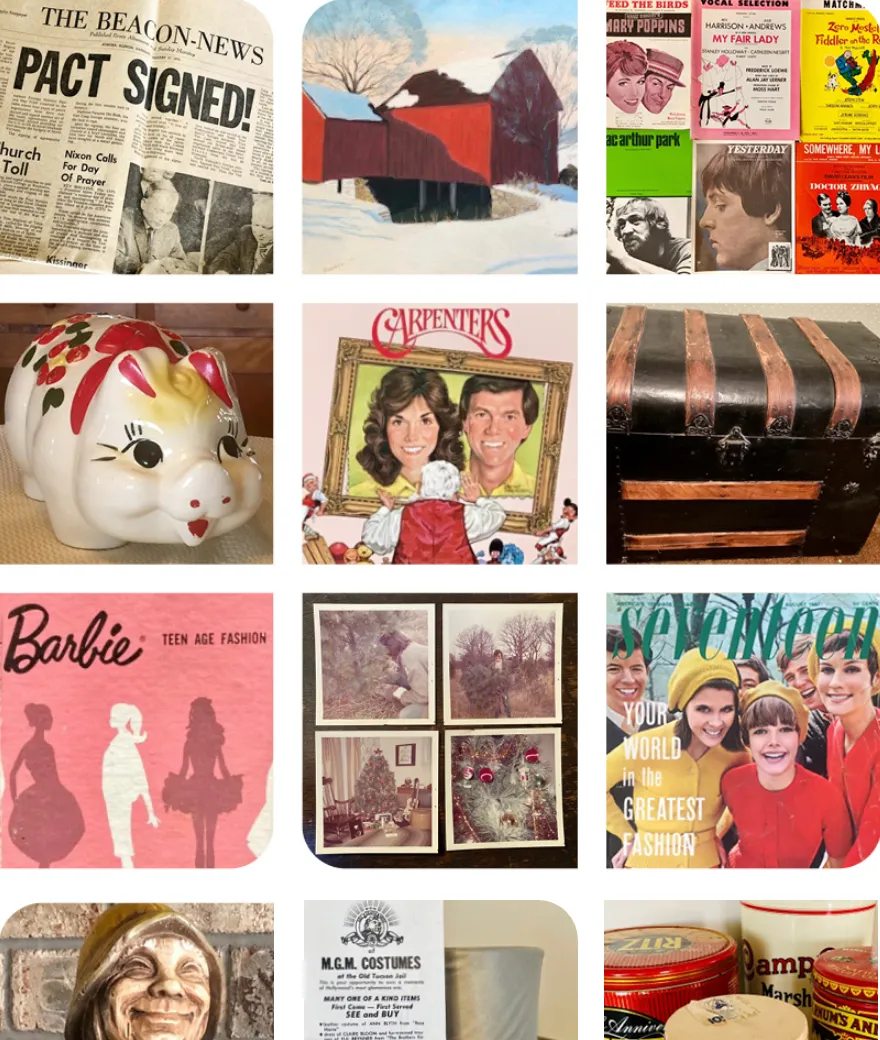

Nickerson: And finally, you’ve experienced firsthand the joy (and usefulness!) of Artifcting. Any advice for our members or thoughts on how Artifcting can aid the appraisal process?

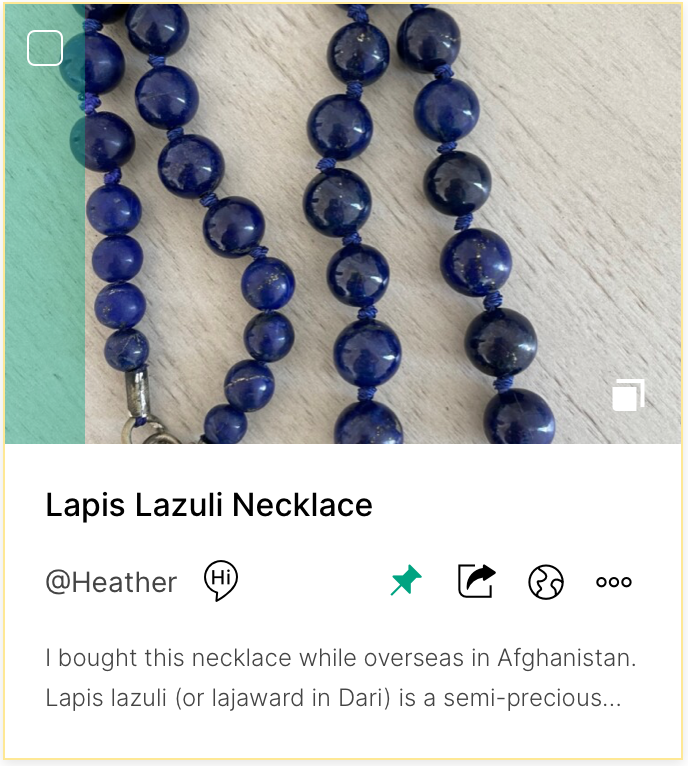

Reeder: Yes! Artifct your ‘stuff.’ Don’t wait! The details, photos, even video can help an appraiser get to work immediately determining an appraisal scope of work and sometimes even using the Artifcts as a resource to appraise items that may now be damaged or lost. It can save a lot of time and back and forth emails if you Artifct and share your Artifcts with your appraiser. Artifcts really is perfect for an appraiser’s workflow!

###

Sarah Reeder is a Certified Member of the Appraisers Association of America, a Certified Member of the International Society of Appraisers with the Private Client Services designation, and a graduate of New York University's Program in Appraisal Studies in Fine & Decorative Arts.

© 2023 Artifcts, Inc. All Rights Reserved.

Sarah's trusty go-everywhere appraisal bag full of her tools of the trade.

Sarah's trusty go-everywhere appraisal bag full of her tools of the trade.

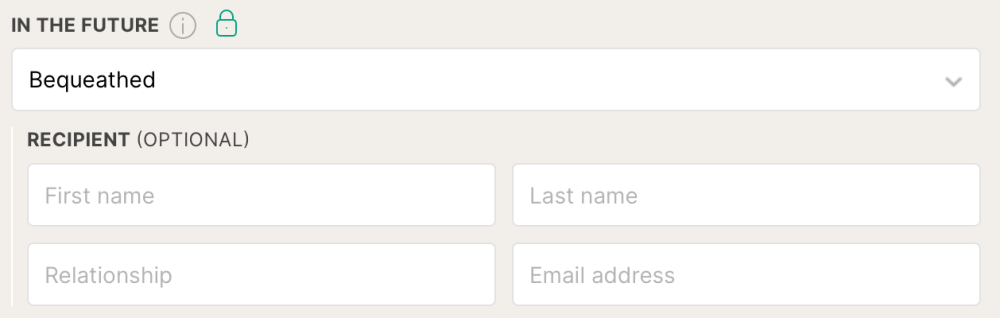

Our 'In the Future' field makes it easy to pass down jewelry and other keepsakes.

Our 'In the Future' field makes it easy to pass down jewelry and other keepsakes.