We’ve all seen recent media articles of Baby Boomers confronting how their possessions should be handled after they’ve died. While the topics of “Swedish death cleaning” and “tidying up” are at the forefront, few articles discuss how “family history” should be passed on, too, so that it contributes to a family’s legacy.

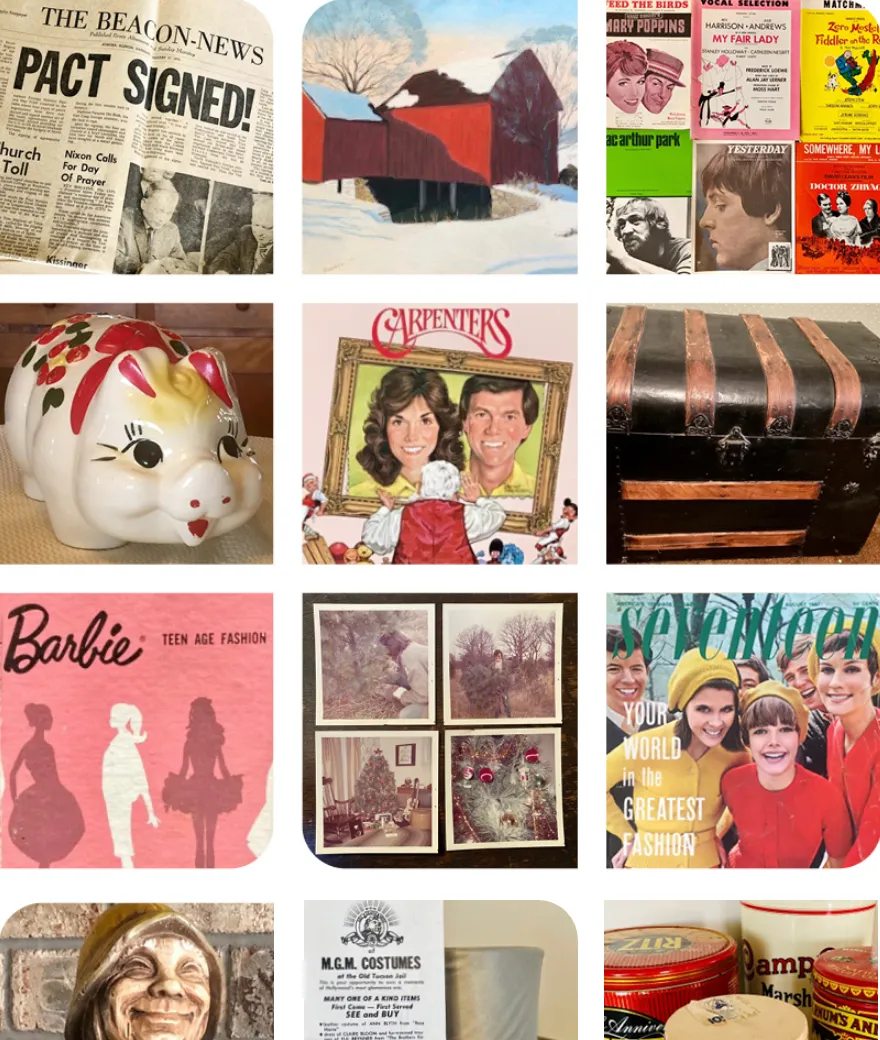

Even if you haven’t self-published a family history book, researched your roots for years, or even built a family tree, you’ve likely been a “steward” for at least some stories, heirlooms, and “stuff.”

Family Keeper vs. Family Steward

There is a big difference between a “keeper” of a family’s history and a “steward” of items which make up that history. Different mindsets seem to govern how each person approaches their possessions.

A keeper often has a protective sense of ownership of items and sometimes becomes defensive when asked to share them. You may have encountered an aunt or an uncle who is sitting on family photo albums, boxes of heirlooms, etc. They tend to treat these items as “holy relics” and have a wealth of stories to go along with each item. And when you ask them how they plan to pass those items on to someone else in the family, often they evade the topic or are at a loss for words (and plans).

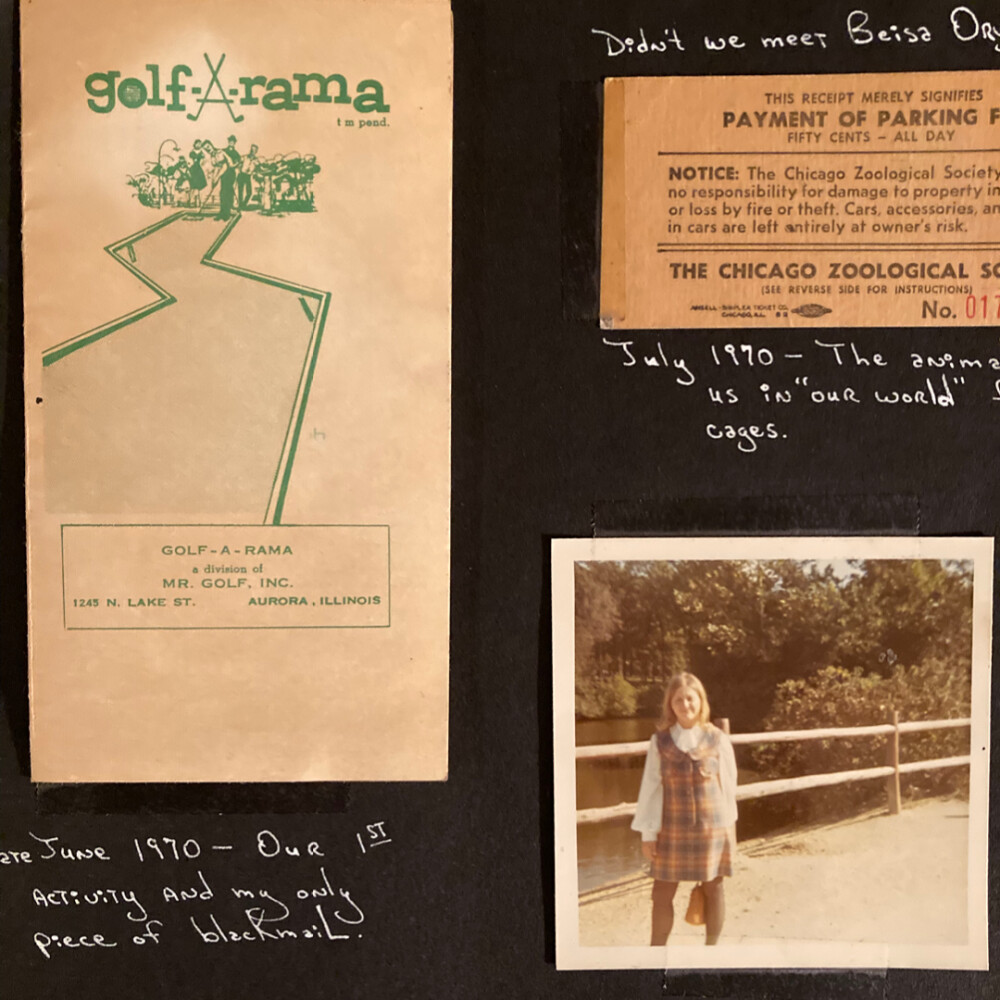

A steward takes a very different approach, like someone tending a garden. Not only have they taken the time to preserve photos and heirlooms against damage and loss, but they’ve also documented the stories that bring those items to life in fixed form, not just in your memory. And after years of cultivating that family history “garden,” they are willing to pass the items to a younger generation of stewards who can continue to preserve the family’s legacy.

Cultivating Your Family History Garden

Going from keeper to steward can be challenging. Here are some tips and tricks on making that journey:

- Take a deep breath. If you are in possession of years of photos and other family items, start with small mini-projects to avoid becoming overwhelmed. This could mean simply sorting photos from slides and negatives. The next project would then be to decide what gets scanned and how to scan them. Then move on to the next project, and the next project, and so on.

- Create a stewardship plan. If you find yourself jumping from project to project without making any progress, create a simple plan. Name the task, write a short description, enter a start date and desired end date. Add a notes section so that if you do jump to a new project without finishing the current one, you note where you left off.

- Set priorities. Some stewards will “rank” their projects using a “1, 2, 3” method. A 1 signifies high priority projects such as interviewing the oldest relatives in the family. Use a 2 for medium priority projects such as documenting family stories and getting them in a fixed format. And finally, 3 is for low priority projects such as file renaming of scanned photos.

- Leverage technology. Today many tools are available to assist with completing those family history projects, and it can be difficult to determine which tools are the best. Look for tools that help you document family stories and heirlooms—like Artifcts—and allow you to share that process and results with other family members.

Artifcts can help you build a virtual “family history library” that is easy to pass on to others in the family. Consider using the QR code available for each Artifct you create and place it on or near an heirloom. The next time family members visit, sit back, and wait for the younger ones to scan the code with their mobile device to learn more about that heirloom. I also recommend printing the QR code for your entire Artifcts collection and including it with your important documents, like your will, deeds, and insurance policies.

Conclusion

We all want to be good caretakers of our family history, but the mere idea of passing away can cause the work of stewardship to be delayed. Remember, you don’t have to go it alone. There are so many products, tools, and services that can help you go from keeper to steward.

And there’s no reason why you can’t involve the younger generation NOW rather than waiting until it is too late. Create a series of family projects using Artifcts to document family heirlooms and to share their stories so those precious items finally have a voice and can be heard.

______________

If family history and genealogy are on your mind, we have additional ARTIcles by Artifcts that might interest you!

###

© 2023 Artifcts, Inc. All Rights Reserved.

Family history, Artifcted!

Family history, Artifcted!