Feeling pressured to tell your life stories?

Has a loved one given you a questionnaire or a book to write in about your life that feels like another to-do?

Does it contain absurdly challenging and broad questions like, "What's one of the most important moments of your life?"

Are you receiving tips on how to “express yourself” or make your stories “entertaining," "thoughtful," or "compelling" and don’t really know where to begin?

(Are you the one creating the pressure?! Keep reading. Today's article is also for you!)

The Story Burden: What Is It?

Maybe you're not a great writer, maybe you don't want to commit the time, or maybe you don't think you have good stories to tell. But "they" are asking you to write or record your stories anyway and maybe even throwing money at it via well-intentioned gifts to encourage you. That is what we call the "story burden."

We know the pressure comes from a heartfelt place. Our friends and family may think we and our stories are worth preserving and sharing. And the storytelling industry wants to help us structure our stories to capture people’s attention in an increasingly distracted world.

At the same time, these story pressures can snowball and become a giant turnoff. The well-intentioned tips, classes, and frameworks may backfire and prevent us from making progress. And progress, not perfection, is what matters, just as much as what “they” want. Right?

Set Your Own Goal

You can't get there, if you don't know where you're going. What is your goal in recording your stories, no matter the format you select? Perhaps your goal looks like one of these:

-

-

- Private, diary-like reflections that maybe you'll share one day with a chosen few.

- Recording bits of your personal and family history to share your knowledge with your loved ones.

- Capturing moments and memories that made you and others smile before the details slip away. These stories could make up the pieces to a great memoir one day!

-

No matter your goal, consider the strategies we've gathered below to see if any will help you make progress without that burden stories can create.

Time-Tested Strategies to Capture Your Stories

STORY PROMPT BOOKS AND CHECKLISTS

Lacking inspiration or searching for a jumping off point? Download a free checklist of interview questions. A great question source is the independent non-profit StoryCorps (check out the podcast, too) and it's FREE collection of life story questions aross 17 categories. Or you could download one of our many Artifcts Inspiration Lists to work through at your pace. These resources will avoid set schedules and fixed costs so you don't have to worry if you fall out of sync with their pace or wonder if you're getting good value for your money. It's free or a one-time fee!

If you're motivated by, let's say, a treat now and then, you could even eat your way to stories. One of our members shared with us how excited their family was to answer the questions wrapped around each of these caramels during the holidays. Talk about low pressure!

SUBSCRIPTION STORY SERVICES

Need more motivation? Subscription services like Storyworth and many others can send you regular prompts by email or have someone call you and by answering them in a timely fashion, by yearend, you’ll have enough fodder to complete and purchase your responses in a book format. For additional fees, you can even add color photos, additional pages, and special covers.

SUPPORT FROM A PRO!

Worried you won't find the time to capture your story without the help of a real human? Hire a life story biographer to interview you and write your story. Whether a short 30-minute session to scratch the surface or a full life story multi-month endeavor, you can find an option to fit your goals and budget and remove the pressure from you to pull it all together. There are an abundance of companies that will do this and range greatly in price. If this is of interest to you, check out our partners, Whole Story Productions and LifeBook Memoirs.

Bite-Sized Stories with Artifcts

We heard a lot about the story burden as we began the research for what became Artifcts. We knew we had to do better and create something innovative that would avoid the story pressure while integrating the best of the tried and tested techniques of story telling AND sharing.

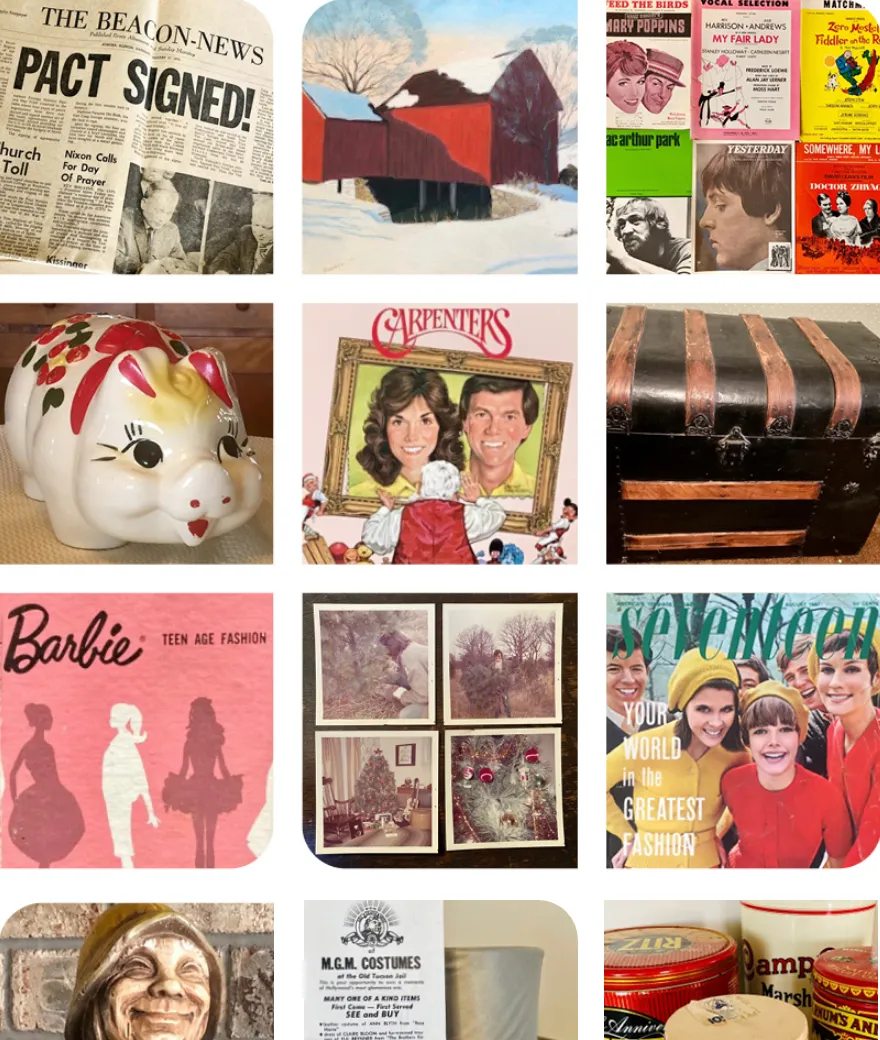

Let's begin at the very beginning. WHAT you choose to Artifct speaks volumes. The fact that you chose to take a moment and document THAT item lets your loved ones know that it mattered to you. The "story" becomes a bonus, a bonus that can be one simple word—e.g. Dad’s—or a 5,000+ word story.

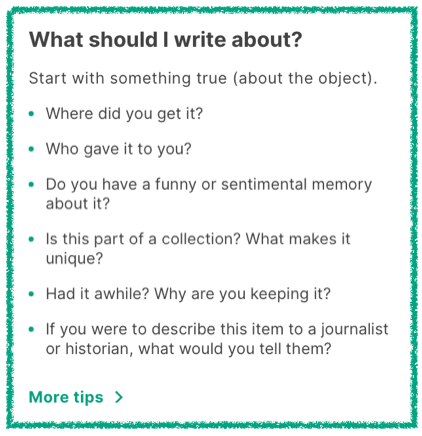

Once you decide WHAT to Artifct, we try to make it as easy as possible to craft a story. If staring at a blank screen leaves you speachless (or wordless), we provide story-writing prompts to help you get started. Pick a prompt and go! Remember, it doesn't have to be perfect, you just have to start.

We also designed Artifcts so you can proceed at your own pace. No pressure, no deadlines. You don't have to worry about missing a week or skipping a question. An Artifct a day, two hours on a Sunday afternoon, seasonal themes, or work your way through a collection, object by object ... whatever works for you! No stress, no quota to meet.

Artifcts are also easily shareable to loved ones or professionals who may be assisting you with family history research, writing a memoir, or creating a family videography, saving you countless hours searching for, sharing, and annotating the materials when you’re ready to take that next step.

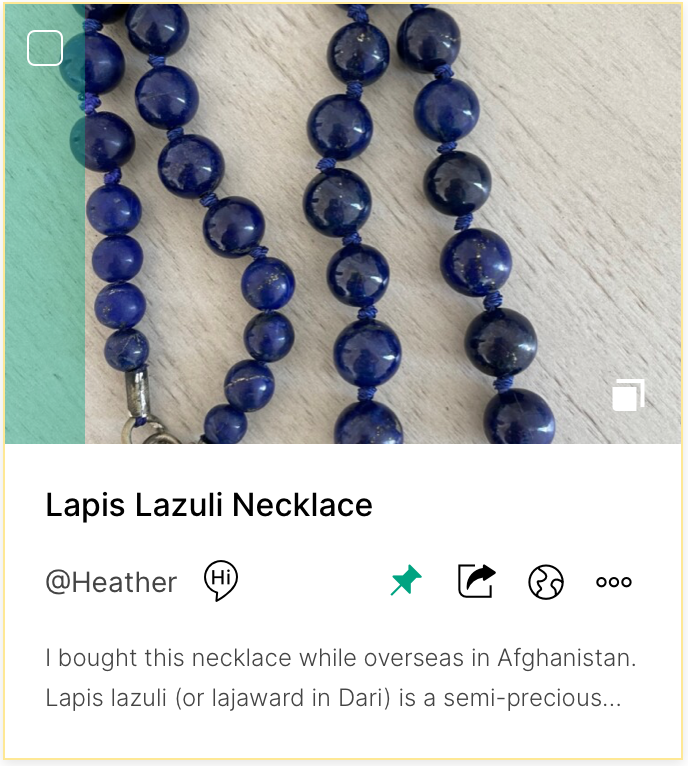

If your family is asking you to share your stories, take it as an invitation—not a burden. You don’t have to write a memoir or capture everything at once. The most meaningful stories often begin with a single object and the memory it holds. With Artifcts, each belonging becomes an easy starting point—a photo, a keepsake, a recipe card, a travel souvenir—each one unlocking a story worth preserving. Don’t let overwhelm stop you or worry about where to begin. Simply choose one object, tell its story in your own words, and start today.

###

© 2026 Artifcts, Inc. All Rights Reserved.

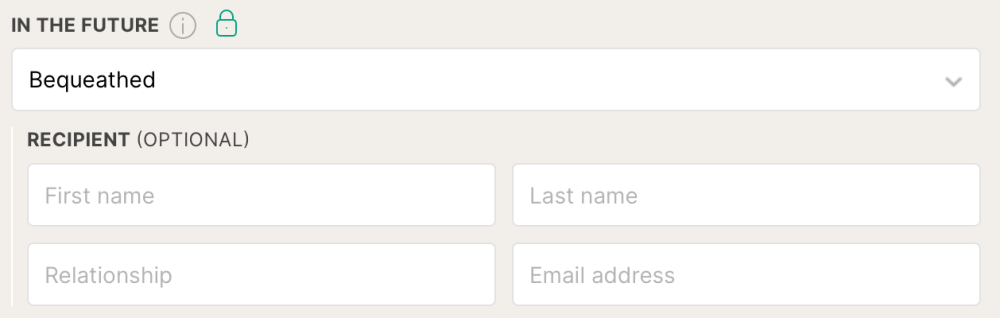

Our 'In the Future' field makes it easy to pass down jewelry and other keepsakes.

Our 'In the Future' field makes it easy to pass down jewelry and other keepsakes.